Chasing Madoff

is a documentary film from 2011. Here is some basic information about it:

** Written,

produced and directed by Canadian filmmaker Jeff Prosserman

** Based on the

book No One Would Listen by Harry Markopolos (2010, 2011)

** Run time: 90 minutes

Bernard Madoff is

a former money manager, who was arrested for fraud in December 2008. In June 2009 he

was sentenced to 150 years in prison.

This film is not

so much about Madoff and his economic crimes, it is more about a small group of

persons – “the fox hounds” - who were convinced that Madoff was a crook and who

tried in different ways to stop him. They contacted the SEC, but they would not

listen to them. They contacted the mass media, but they would not listen to them,

either. Their attempts to stop Madoff went on for almost a decade, from May 2000

until he was arrested in December 2008.

In the end, Madoff

was not brought down by the fox hounds, nor the SEC or the media. He was

brought down by the market, by the general economic crisis of 2008, which meant

that he could not find the new clients nor the new money that he needed to

sustain his operations. At that point he confessed to his sons who reported him

to the FBI. He was arrested the following day.

An on-screen

message at the beginning of the film says: “Unfortunately, a true story.”

Several witnesses

were interviewed for the film. They can be divided into three categories: the

fox hounds, former Madoff investors, and other witnesses.

THE FOX HOUNDS

** Harry

Markopolos, former chief investment officer, Rampart Investment Management

** Frank Casey,

former senior vice-president of marketing, Rampart Investment Management,

Harry’s boss

** Neil Chelo,

former portfolio manager, Rampart Investment Management, Harry’s assistant

** Michael Ocrant,

reporter, former editor of MAR Hedge (a newsletter about hedge funds)

** Gaytri Kachroo,

lawyer, head of corporate department, Donovan Hatem LLP, Harry’s lawyer

FORMER MADOFF

INVESTORS

** Madoff account

46-225657

** Madoff account

48-245899

** Madoff account

24-45678

** Madoff account

56-259984

** Madoff account

85-238586

** Madoff account

4-245711

OTHER WITNESSES

** David Kotz,

inspector general, SEC

** Sergeant Harry

Bates, Whitman Police Department

** Louis and

Georgia Markopolos, Harry’s parents

** James Ratley,

president, Association of Certified Fraud Examiners

** Elaine Drosos,

Venus Pizza

PART ONE

In 1999, Frank

Casey heard about a money manager in New York, who offered his clients a stable

return on their investments of ca. 1 per cent per month. He went to New York

and found out that the name of the money manager with the magic touch was

Bernard Madoff. He got the name from Rene-Thierry Magon de Villehuchet, who was

an important person in the world of finance.

When Casey

returned to Boston, he talked to Harry Markopolos about it. He said to him:

look what Madoff is offering his clients. We should do the same. How does he do

it? Markopolos studied the documents that Casey had showed him and after a

while he concluded: it is a fraud, it is a Ponzi scheme. When Markopolos asked

his assistant Neil Chelo to check the numbers, he came to the same conclusion.

From that moment the trio decided that they had to do something to stop Madoff.

In May 2000,

Markopolos sent a document with his conclusions to the SEC. There was no

response. In early 2001, Casey met with Michael Ocrant. They talked about

Madoff, and Ocrant decided to join the trio. By now the small group hunting

Madoff was a quartet. Ocrant promised to publish an article about Madoff in his

newsletter, which he did. The article was published on 1 May 2001. One week

later, an article with similar suspicions was published in Barron’s, a weekly

paper about the financial market. The second article was written by Erin

Arvedlund (while her name is mentioned, she is not interviewed in the film).

The members of the

quartet believed that these two articles would change everything. They were

wrong. There was no response. The media did not pick up the story. The SEC did

not start an investigation.

As time went by,

Markopolos began to fear for his safety. He acquired a permit to have a

firearm. He also felt he should hire a lawyer. When he met with Gaytri Kachroo,

he asked her to be his lawyer. She agreed. Now the quartet hunting Madoff was a

quintet.

In the film we

follow the fox hounds – primarily Markopolos – in their efforts to stop Madoff.

When Madoff was arrested in December 2008, it was soon revealed that Markopolos

and his friends had been trying to alert the SEC for several years, and that no

one had listened to them. Now Markopolos got his chance. He was invited to

testify before a House Committee. He was also given an award by the Association

of Certified Fraud Examiners.

As explained in

the film, the story about Madoff included a sad PS: Rene-Thierry Magon de

Villehuchet decided to take his own life. Casey had tried to warn him about

Madoff, but he had insisted that Madoff was completely honest. Villehuchet had

not only placed his own assets with Madoff. He had also advised many of his rich

friends to do the same. Some of them had invested millions with Madoff. Feeling

responsible for the tragic loss that these people had suffered, he decided that

there was only one solution left for him.

PART TWO

Chasing Madoff

got mixed reviews on Amazon, all the way from one star to five stars. I can

understand why, because this film is a curious blend of something great and

something terrible. There is a great story here. But it is told in a terrible

way. There are many problems with this film, many things are strange and puzzling,

many things do not make sense, many things do not add up.

First of all,

Markopolos is full of himself. His behaviour is abrasive and arrogant. He

claims he knew at once that Madoff was a fraud: “It took me five minutes to

figure it out.” He is self-righteous. Again and again he has this attitude

which says: “I told you so.”

Secondly, he is

paranoid. He has this idea that Madoff is going to kill him or more precisely

send a professional hitman to kill him in order to silence him. He gets a permit

to carry a firearm. We see the policeman who helped him with this. When we see

him practice shooting, he has a rifle. Why would you get a rifle to protect

yourself? It is not exactly a handy weapon. Later we see him with a gun.

He also gets a

bullet-proof vest, because he thinks he needs protection. We see the policeman

who helped him with this. Before driving anywhere, he checks under the car to

see if anybody has planted a bomb there. While driving, he checks the rear-view

mirror to see if he is being followed by someone who wants to kill him.

Obviously, these scenes are re-enacted after Madoff was arrested.

He is paranoid. He thinks somebody is out to get him, but it is not true. Moreover, his

paranoia does not make any sense. Why did he decide to get married and to have

three kids, if he thought he was a target of a professional killer? How clever is that?

When talking about

his family, he says: “I was way too young when I got married. I was only 42.”

This is a strange statement. Are you too young to get married when you are 42? Most people would think you

are more than old enough.

When Casey asks

Markopolos if he is sure Madoff is a fraud, Markopolos is offended: “How can

you not believe me?” But later he tells us that he asked his assistant to check

the numbers to make sure that he was right.

When Casey tells

Ocrant about Madoff, Ocrant is shocked. Apparently, he had never heard about

him before. But later Ocrant says: “I had known Madoff on and off, throughout

the years.” This does not add up.

When former Madoff

investors appear, they are only identified by their account number. This is

probably in order to protect their identity. But the names are listed at the

end of the film, during the credit roll. What is the point of this? At first

the names are not given, but later they are given anyway. This is very strange.

This does not make any sense.

PART THREE

When Markopolos

says he fears for his life, his words are accompanied by a picture that shows some

people carrying a coffin at a funeral. When he says he is afraid somebody is

going to kill him, his words are accompanied by a picture which shows a

mafia-style execution. This happens several times. But these pictures have

nothing to do with him. As far as we can tell, nothing bad ever happened to him

or his family. The pictures used in the film are dramatic but completely irrelevant.

At one point

Markopolos wants to protect his documents from the SEC. He is afraid they will raid

his house and seize his computer and all his documents. Why is he afraid of that?

The SEC already has his documents. He himself sent them to the SEC several

years before. Why is he afraid? His fear does not make any sense.

He drives to the

nearest pizza restaurant, in a highly agitated state of mind, and says: I have

to use your fax machine! I have to send some documents! We see the waitress in

the pizza restaurant who helped him with this.

But why would

anyone send a long document via a fax machine? It takes forever, because you

have to send it one page at a time. Why not send the document as an attachment

to an email? This method takes less than a minute. Once again, we have a scene

which does not make any sense.

Towards the end of

the film Markopolos tells us that he does not regard himself as a hero. He is

simply a citizen who did the right thing. But in the same scene we see him with

the twins and one of them says: “My dad is my hero.”

The thing is:

Markopolos was right about Madoff, and he has the right to say so. But his

attitude, his behaviour, his manners do not work in his favour. Strictly

speaking, his attitude is irrelevant. The only thing that matters is this: was

he right? And the answer is: yes, he was right.

However, when you

are making a movie about Markopolos and his crusade against Madoff, you have to

think about how the leading character comes across on the screen. You want him

to seem convincing, to seem credible, you want the viewer to like and trust

him, and this is rather difficult when Markopolos behaves like an arrogant

know-it-all who has nothing but contempt for those who do not agree with him or

do not understand him.

Why did Jeff

Prosserman use the re-enacted scenes to show the paranoia, including the picture

which shows the people carrying a coffin at a funeral and the picture which

shows a mafia-style execution? These elements are counter-productive. They

damage the film. Without these elements the film would have been better and shorter.

CONCLUSION

The story about

the fox hounds – Markopolos and his friends who are trying to tell the truth

about Madoff and his crimes while no one would listen – could have been a great

documentary film. But the film that Prosserman made is far from great. It is

marred by scenes, which do not make any sense, which are strange, which are

puzzling and sometimes completely irrelevant.

I understand the

negative reviews and I have to agree with them. There is a great story here,

but it is told in a terrible way. What a shame! This film is fatally flawed. It

cannot get more than two stars. If you wish to know about Madoff and the

financial crisis of 2008 there are other sources which are much better.

PS # 1. For more

information, see the following films:

** Ripped Off:

Madoff and the Scamming of America. This film was shown on the History Channel

in April 2009.

** The Madoff

Affair. This film was shown on US television (PBS) in May 2009. It is an

episode of the long-running program Frontline (season 27, episode10).

PS # 2. For more

details about Madoff, see the following books:

** Bernie Madoff:

The Wizard of Lies by Diana Henriques (2011)

** Too Good to Be

True: The Rise and fall of Bernie Madoff by Erin Arvedlund (2010)

PS #

3. Madoff is a movie that was shown on US television (ABC) in February 2016.

The leading role is played by Richard Dreyfuss. The Wizard of Lies is a movie

that will be shown on US television (HBO) in 2017. In this version, the

leading role is played by Robert De Niro.

*****

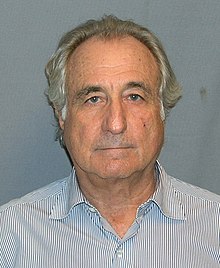

Bernard Madoff (born 1938)

Currently serving a sentence of 150 years in prison

*****

![Ripped Off: Madoff And The Scamming Of America [DVD] [2009] [Region 1] [US Import] [NTSC]](http://ecx.images-amazon.com/images/I/51k%2Bk9PkXcL.jpg)